The second is through quarterly estimated payments. The first is direct withholding of the tax at the time of payment from an employer. The federal income tax is collected three ways. Married couples can be taxed together or separately. In fact, anyone who earns income in the US can be taxed. How federal income tax worksĬitizens and residents, corporations, trusts, estates, and other legal entities all pay income tax on their worldwide income, unless it is specifically exempted by law. The federal income tax originated in the 1860s when the government needed to raise funds for the Civil War, and was ratified into law in 1913 with the 16th amendment. Individual incomes are taxed at progressively higher rates as the total taxable amount increases, while businesses are taxed at a flat rate. Income can come from a job, investments, a business, or retirement funds, and most of it is taxable.

The federal income tax is levied by the Internal Revenue Service on individual and corporate income to pay for government services. Internet costs and office supplies are a few examples.By clicking ‘Sign up’, you agree to receive marketing emails from InsiderĪs well as other partner offers and accept our But this also offers an opportunity to offset your income by writing off expenses for things you need to do your job. "If you're primarily working as a freelancer, you'll want to keep careful records of both your income and your expenses related to work.Ĭompanies don't always withhold taxes on payments they make to outside contractors, so it's up to you to tell the IRS what you made. "That said, you have to make sure you're calculating these properly, as carelessness or dishonesty can lead to audits or penalties. It's not just legal to use these strategies it's a smart money move," Andy Rosen, taxes and investing specialist at personal finance app NerdWallet, told Newsweek. "Deductions, write-offs and other ways to reduce your taxable income are built right into U.S.

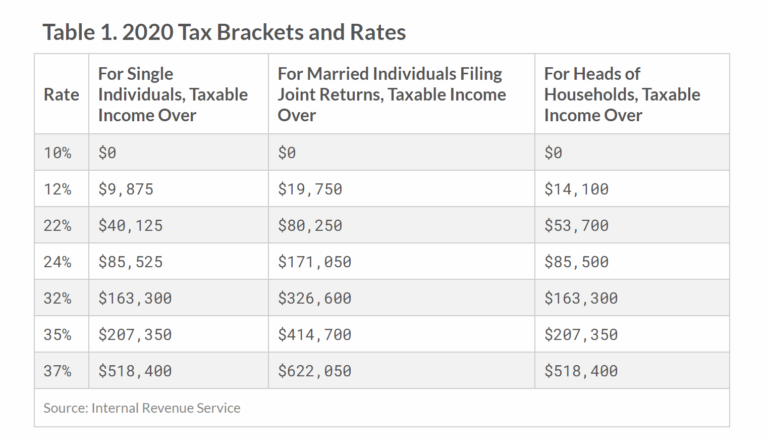

There is a 22 percent tax applied to income between $41,776 to $89,075 for single filers, and $83,551 to $178,150 for joint filers. Income between $10,276 to $41,775 for single filers, and $20,551 to $83,550 for joint filers is taxed at 12 percent. The taxable income rate for single filers earning up to $10,275 is 10 percent, and for joint married filers is 10 percent tax on income up to $20,550. Tax brackets for 2022 have gotten slightly wider, meaning more income is taxed at a lower percent rate GettyĪmerican incomes are taxed at a marginal rate, which means you pay each percentage rate for the amount of your income that falls into that specific range. Stock photo of tax return forms and cash.

0 kommentar(er)

0 kommentar(er)